best cryptocurrency to invest in 2025

- Cryptocurrency market analysis march 2025

- Cryptocurrency market trends 2025

- Cryptocurrency market analysis february 2025

Best cryptocurrency to invest in 2025

In contrast to the broad market downturn, specific cryptocurrencies like Bitcoin Cash and Solana displayed divergent behaviors. Bitcoin Cash led gains among altcoins, hinting at market segments that still find investor favor lasalantis. Meanwhile, Solana, after a significant high of $150, faced only a minor pullback to $148, despite negative predictions based on market sentiment and technical indicators.

After the April tariff policy is implemented, the optimistic scenario is that Trump’s tariff policy doesn’t trigger large-scale trade retaliation, and the Fed releases dovish signals (such as hints at rate cuts), BTC could break through the $90,000 resistance level and test the $100,000 mark; but the pessimistic scenario is, if tariff conflicts escalate and PCE data exceeds expectations, BTC may test the $75,000-$80,000 support range, and the altcoin market may accelerate its collapse.

The optimistic scenario is weak or as-expected data, i.e., new job additions ≤150,000, unemployment rate ≥4.3%, wage growth slowing. Rate cut expectations rise, dollar retreats, BTC may break through resistance levels and strengthen with fluctuations.

Cryptocurrency market analysis march 2025

Analyzing cryptocurrencies, the Binance Research team found that the supply of bitcoin (BTC) belonging to long-term holders is increasing. There has also been significant Bitcoin adoption since establishing a U.S. strategic Bitcoin reserve, with institutions increasingly buying the asset.

Analyzing cryptocurrencies, the Binance Research team found that the supply of bitcoin (BTC) belonging to long-term holders is increasing. There has also been significant Bitcoin adoption since establishing a U.S. strategic Bitcoin reserve, with institutions increasingly buying the asset.

The 2025 Dogwifhat (WIF) prediction is a range from $0.45 to $2.50. Community support and crypto market interest will remain key drivers. If favorable conditions persist, WIF could see its price inflate substantially in 2025.

The Securities and Exchange Commission (SEC) recently clarified that most memecoins are not categorized as securities under federal laws. This clarification provides a legal framework for meme token creators and reduces compliance uncertainties. However, it also serves as a reminder for investors to exercise caution, as these assets may lack intrinsic value.

In 2025, FLOKI is forecasted to range between $0.000102 and $0.000335. Drivers for FLOKI in 2025: continued community support and investor interest confirming the continuation of the meme coin mega cycle.

In a landmark move, President Donald Trump signed an executive order to establish a government bitcoin reserve. This initiative involves the U.S. government retaining approximately 200,000 bitcoins confiscated through various proceedings, positioning it as a “digital Fort Knox.” The reserve aims to bolster the nation’s economic competitiveness and reflects a significant shift towards mainstream acceptance of cryptocurrencies.

Cryptocurrency market trends 2025

Yes. Singapore, Hong Kong and select EU nations have embraced proactive policies that encourage a vibrant crypto sector. Meanwhile, U.S. markets are seeing a mix of cautious sentiment from tariffs and optimism from new crypto-focused government bodies. In heavily restricted countries like China, mainstream adoption is stifled, but underground or offshore activities persist.

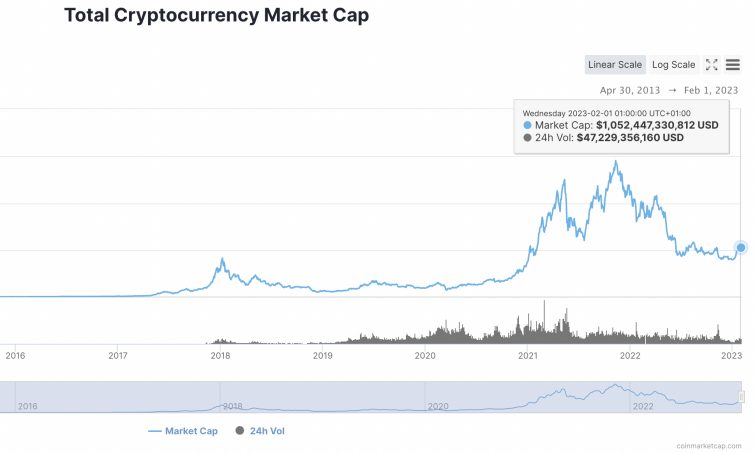

2024 saw a monumental shift for Bitcoin and digital assets. New products, record inflows, monumental policy shifts, growing adoption, and solidification of Bitcoin as an institutional asset marked 2024.

Stablecoin legislation will pass both houses of Congress and be signed by President Trump in 2025, but market structure legislation will not. Legislation that formalizes and creates a registration and oversight regime for stablecoin issuers in the United States will pass with bipartisan support and be signed into law before the end of 2025. Growing USD-backed stablecoin supply is supportive of dollar dominance and Treasury markets, and when combined with the expected easing of restrictions for banks, trusts, and depositories, will lead to significant growth in stablecoin adoption. Market structure – creating registration, disclosure, and oversight requirements for token issuers and exchanges, or adapting existing rules at the SEC and CFTC to include them – is more complicated and will not be completed, passed, and signed into law in 2025. -Alex Thorn

This piece was originally sent to Galaxy clients and counterparties on December 27, 2024. Cryptocurrency and Bitcoin predictions were compiled by members of the Galaxy Research team between December 16 and December 27, 2024.

Cryptocurrency market analysis february 2025

The crypto market has seen an unprecedented surge in new token launches, driven by the rise of token launchpads and memecoin speculation. As of January 2025, over 37 million tokens had been created, with estimates suggesting this number could surpass 100 million by the end of the year.

The key level to watch for PEPE is $0.00000633, which represents PEPE’s 38.2% Fibonacci level acting as a a critical support and potential rebound point. A successful rebound from this level could confirm a lasting bottom. The meme coin’s performance will largely depend on market sentiment and social media trends.

Similar to traditional finance, the crypto ecosystem has long been a male-dominated investment class. But women across the globe have increasingly opted to invest in crypto, narrowing the gender gap in ownership in the majority of countries surveyed.

Apart from all the factors revealed by Crypto Street, Binance Research also addressed two other significant elements worth paying attention to in February: upcoming events and significant token unlocks.

Analysis of February’s crypto market outlook, featuring Bitcoin’s strong historical performance (10:2 positive ratio), key events including BoE rate decision, US economic data, and FTX repayment impact, amid potential Lunar New Year volatility.